Credit Score Improvement takes center stage in the financial world, so buckle up as we dive into the key strategies and tips to level up your credit game. Get ready to rock your financial future!

Understanding what a credit score is and how it affects your financial life is crucial. Let’s explore the ins and outs of credit score improvement together.

Understanding Credit Scores: Credit Score Improvement

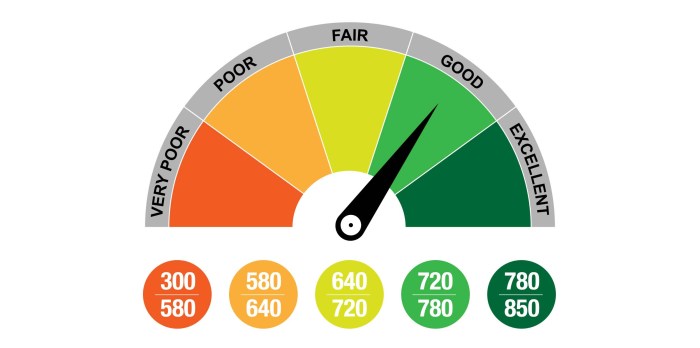

A credit score is a numerical representation of an individual’s creditworthiness, which is used by lenders to determine the likelihood of the borrower repaying their debts. It is calculated based on various factors related to a person’s credit history and financial behavior.

Importance of Having a Good Credit Score

Your credit score plays a crucial role in your financial life, impacting your ability to secure loans, credit cards, and favorable interest rates. A good credit score can help you qualify for better financial opportunities and save money in the long run.

Factors Influencing a Credit Score

- Payment History: This is the most significant factor affecting your credit score, reflecting whether you have paid your bills on time.

- Credit Utilization: The amount of credit you use compared to your total available credit limit can impact your score. Keeping this ratio low is ideal.

- Length of Credit History: The longer your credit history, the better, as it provides a more comprehensive picture of your financial behavior.

- Types of Credit: Having a mix of credit accounts, such as credit cards, loans, and mortgages, can positively impact your score.

- New Credit Inquiries: Opening multiple new credit accounts in a short period can signal financial distress and lower your credit score.

Strategies for Credit Score Improvement

Improving your credit score is crucial for financial health and stability. By following some key strategies, you can work towards achieving a better credit score.

The Impact of Paying Bills on Time, Credit Score Improvement

Paying your bills on time is one of the most important factors that contribute to your credit score. Late payments can significantly damage your score, so it’s essential to pay all your bills by their due dates. Setting up automatic payments or reminders can help you stay on track and avoid any late payments.

Reducing Credit Card Balances

Another effective strategy for improving your credit score is reducing your credit card balances. High credit card balances can negatively impact your score, so aim to keep your credit utilization ratio low. Ideally, you should aim to use less than 30% of your available credit. Paying off credit card balances in full each month can help lower your credit utilization ratio and boost your credit score.

Monitoring Credit Scores

Regularly checking your credit scores is crucial in maintaining financial health and ensuring accuracy in your credit profile. By monitoring your credit scores, you can stay informed about any changes or discrepancies that may impact your overall creditworthiness.

Ways to Monitor Credit Scores

- Utilize free credit monitoring services offered by various financial institutions or credit bureaus.

- Sign up for credit monitoring apps or websites that provide regular updates on your credit scores and reports.

- Set up alerts and notifications to receive real-time updates on any changes to your credit profile.

Reviewing Credit Reports for Score Improvement

- Obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, TransUnion) annually.

- Thoroughly review your credit reports for any errors, inaccuracies, or fraudulent activities that may be impacting your credit scores.

- Dispute any discrepancies found on your credit reports to ensure that your credit scores accurately reflect your credit history.

Building Credit History

Building a positive credit history is crucial for improving your credit score and gaining access to better financial opportunities. Your credit history plays a significant role in determining your credit score, as it provides a record of your past credit use and payment behavior. Lenders use this information to assess your creditworthiness and decide whether to approve your loan applications.

Impact of Opening New Credit Accounts

Opening new credit accounts can impact your credit score in several ways. It can initially lower your score due to the hard inquiry that occurs when a lender checks your credit report during the application process. Additionally, having a new account can reduce the average age of your credit history, which is a factor in calculating your credit score. However, if you manage the new account responsibly by making on-time payments and keeping your credit utilization low, it can ultimately have a positive impact on your credit score over time.

Strategies for Building a Positive Credit History

- Make on-time payments: Paying your bills on time is one of the most important factors in building a positive credit history. Late payments can significantly damage your credit score, so it’s crucial to always pay on time.

- Keep credit card balances low: Maintaining a low credit utilization ratio, which is the amount of credit you’re using compared to your total credit limit, can help improve your credit score. Aim to keep your utilization below 30%.

- Limit new credit applications: Applying for multiple new credit accounts within a short period can raise red flags to lenders and potentially lower your credit score. Be strategic about when and how often you apply for new credit.

- Monitor your credit report: Regularly checking your credit report for errors or fraudulent activity can help ensure that your credit history is accurate and up-to-date. You’re entitled to a free credit report from each of the three major credit bureaus every year.