Passive Income Ideas open up a world of financial possibilities, allowing you to earn money without constant effort. From real estate investments to online business ventures, this guide will explore various strategies to help you build a sustainable income stream.

Introduction to Passive Income Ideas

Passive income is money earned with minimal effort or involvement. It is income that comes in regularly without requiring a lot of ongoing work. Having passive income streams can provide financial stability, flexibility, and the potential to achieve financial independence.

Benefits of Passive Income Streams

Creating passive income streams can offer various benefits, such as:

- Financial Freedom: Passive income can supplement your primary income and help you achieve financial goals.

- Flexibility: With passive income, you have the freedom to choose how and when you work.

- Scalability: Passive income streams have the potential to grow over time, increasing your earnings.

- Diversification: Having multiple passive income streams can help protect you from financial uncertainties.

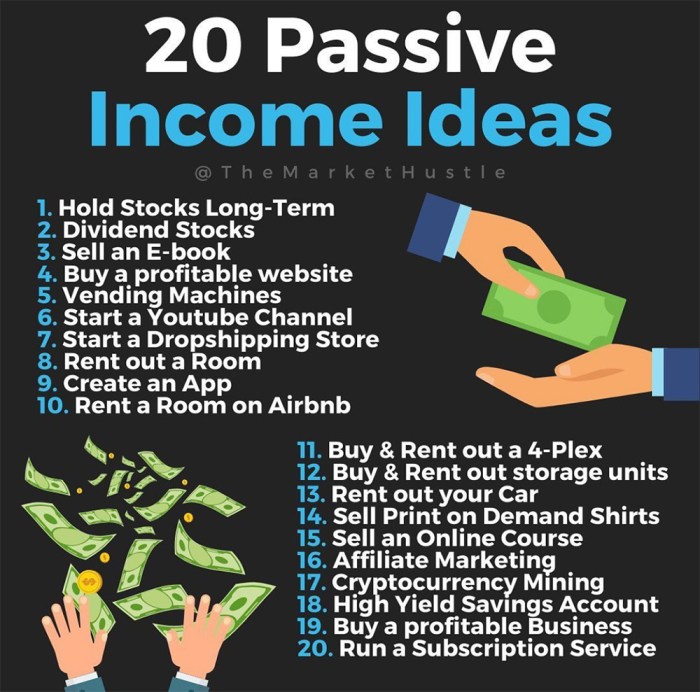

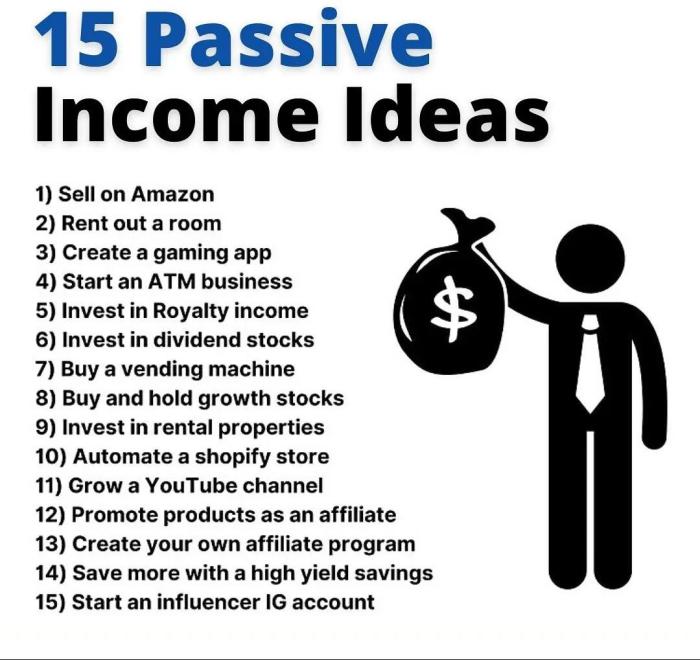

Examples of Passive Income Opportunities

There are several ways to generate passive income, including:

- Rental Properties: Earn income through renting out properties.

- Dividend Stocks: Receive regular payments from owning shares in companies.

- Online Courses: Create and sell courses on platforms like Udemy or Teachable.

- Peer-to-Peer Lending: Earn interest by lending money to individuals or businesses.

Real Estate Investments

Real estate investments can be a great way to generate passive income. By purchasing properties and renting them out, you can earn a steady stream of income without actively working for it. Here are some tips for beginners interested in real estate investing:

Pros and Cons of Investing in Rental Properties

- Pros:

- Rental income: You can earn money each month from tenants renting your property.

- Property appreciation: Real estate tends to increase in value over time, allowing you to build equity.

- Tax benefits: You may be able to deduct expenses such as mortgage interest, property taxes, and maintenance costs.

- Cons:

- Property management: Dealing with tenants, maintenance, and other issues can be time-consuming.

- Market volatility: Real estate markets can fluctuate, impacting the value of your investment.

- Initial costs: Buying a rental property requires a significant upfront investment.

Online Business Ventures

Starting an online business can be a lucrative way to generate passive income. With the right strategies and platforms, you can create a successful online venture that earns money while you sleep.

Various Online Business Ideas

- Dropshipping: Set up an online store without holding any inventory, as products are shipped directly from the supplier to the customer.

- Affiliate Marketing: Promote products or services and earn a commission for each sale made through your unique affiliate link.

- Print on Demand: Create custom designs for merchandise like t-shirts, mugs, and phone cases, and sell them online without the need for inventory.

Comparison of E-commerce Platforms

- Shopify: Known for its user-friendly interface and extensive app store, Shopify is a popular choice for setting up an online store.

- WooCommerce: A plugin for WordPress, WooCommerce allows for customization and integration with other WordPress features.

- BigCommerce: Ideal for scaling your online business, BigCommerce offers robust features for growth and expansion.

Tips for Creating a Successful Online Business

- Identify a niche market with high demand and low competition to stand out in the crowded online space.

- Focus on providing excellent customer service to build trust and loyalty with your audience.

- Utilize social media and digital marketing strategies to drive traffic to your online store and increase sales.

Dividend Stocks and Investments

When it comes to generating passive income, dividend stocks can be a lucrative option. These stocks are shares of companies that distribute a portion of their earnings to shareholders in the form of dividends. By investing in dividend stocks, investors can earn regular income without having to actively work for it.

Top Dividend-Paying Companies for Investment

- Company A: Known for its consistent dividend payouts and strong financial performance.

- Company B: Offers a high dividend yield and has a history of increasing dividends over time.

- Company C: A stable company with a solid track record of dividend payments.

Importance of Diversification in Dividend Stock Portfolios

Building a diversified portfolio of dividend stocks is essential to reduce risk and maximize returns. By spreading investments across different companies and industries, investors can protect themselves from the impact of a downturn in any one sector. Diversification also helps to ensure a steady stream of passive income even if some companies reduce or suspend their dividends.

Peer-to-Peer Lending

Peer-to-peer lending is a form of investing where individuals lend money to borrowers through online platforms. Investors earn passive income through interest payments made by borrowers.

Different Peer-to-Peer Lending Platforms, Passive Income Ideas

- LendingClub: One of the largest peer-to-peer lending platforms, offering personal and business loans.

- Prosper: Allows investors to fund personal loans for borrowers with different credit profiles.

- Upstart: Utilizes AI and machine learning to assess borrower creditworthiness.

Tips for Mitigating Risks in Peer-to-Peer Lending

- Diversify Your Investments: Spread your investment across multiple borrowers to reduce the impact of potential defaults.

- Research Borrowers: Review borrower profiles and loan purposes to make informed investment decisions.

- Understand Platform Fees: Be aware of any fees charged by the peer-to-peer lending platform to ensure you factor them into your returns.

- Monitor Your Investments: Regularly check the performance of your loans and adjust your strategy accordingly to maximize returns.