Credit Score Improvement is key to unlocking financial success, paving the way for lower interest rates, better opportunities, and a brighter future. Get ready to dive into the world of improving your credit score with style and finesse.

Importance of Credit Score Improvement

Improving your credit score is crucial for maintaining good financial health. A better credit score can open up a world of opportunities and benefits in the realm of personal finance.

Lower Interest Rates on Loans

Having a higher credit score can lead to lower interest rates on loans. Lenders use credit scores to assess the risk of lending money to individuals. A good credit score indicates that you are a responsible borrower, making you eligible for lower interest rates. On the other hand, a poor credit score can result in higher interest rates, costing you more money over time.

Access to Credit Cards and Financial Opportunities

A good credit score can also grant you access to credit cards with better rewards and benefits. Credit card companies are more likely to approve applications from individuals with good credit scores, as they are seen as less risky. Additionally, a positive credit history can open doors to other financial opportunities, such as favorable terms on mortgages, insurance premiums, and even job opportunities that require a credit check.

Factors Affecting Credit Score

Understanding the key factors that influence your credit score is crucial for maintaining good financial health and access to credit when needed.

Payment History

- Payment history is the most important factor in determining your credit score.

- It accounts for about 35% of your total score.

- Consistently making on-time payments helps boost your score, while late payments can have a negative impact.

- To improve this factor, set up automatic payments or reminders to ensure you never miss a payment.

Credit Utilization

- Credit utilization ratio is the amount of credit you’re using compared to your total available credit.

- This ratio makes up about 30% of your credit score.

- Keeping your credit utilization below 30% is ideal for a good score.

- To address this factor, consider paying down balances or requesting a credit limit increase.

Length of Credit History

- The length of your credit history makes up about 15% of your credit score.

- A longer credit history shows lenders that you have experience managing credit responsibly.

- To improve this factor, keep old accounts open and avoid opening too many new accounts at once.

New Credit and Credit Mix

- New credit applications and the variety of credit accounts you have make up the remaining 20% of your credit score.

- Opening multiple new accounts in a short period can be seen as risky behavior.

- Having a mix of credit types, like credit cards, loans, and a mortgage, can show that you can handle different types of credit responsibly.

- To address this factor, be cautious when applying for new credit and aim for a diverse credit portfolio over time.

Tips for Credit Score Improvement

Improving your credit score is essential for your financial health. Here are some actionable tips to help you boost your credit score effectively:

1. Pay Your Bills on Time

- Set up automatic payments to ensure you never miss a due date.

- Pay at least the minimum amount due on all your accounts.

2. Reduce Your Debt, Credit Score Improvement

- Focus on paying off high-interest debt first.

- Avoid maxing out your credit cards and aim to keep your credit utilization below 30%.

3. Monitor Your Credit Reports Regularly

- Check your credit reports from all three major credit bureaus (Equifax, Experian, TransUnion) for errors or discrepancies.

- Report any inaccuracies to the credit bureaus to have them corrected.

Impact of Credit Score Improvement on Financial Goals

Improving your credit score can have a significant impact on achieving your financial goals. A higher credit score can help you secure better interest rates on loans and credit cards, saving you money in the long run. It can also open up opportunities for larger credit limits, making it easier to make big purchases like a house or car.

Relationship between Credit Score and Major Life Milestones

Having a good credit score is crucial when it comes to major life milestones like buying a house or car. Lenders use your credit score to determine your creditworthiness and the interest rates you qualify for. A higher credit score can mean lower interest rates, ultimately saving you thousands of dollars over the life of a loan.

- Higher credit score can lead to lower interest rates on mortgages, resulting in lower monthly payments and overall savings.

- Improved credit score can help you qualify for better auto loan rates, reducing the total cost of the vehicle over time.

- Good credit score can also make it easier to secure financing for other major purchases, such as home renovations or education expenses.

Success Stories of Credit Score Improvement

There are numerous success stories of individuals who have worked on improving their credit score and achieved financial stability. By diligently managing their finances, making on-time payments, and reducing their debt, these individuals were able to see significant improvements in their credit scores.

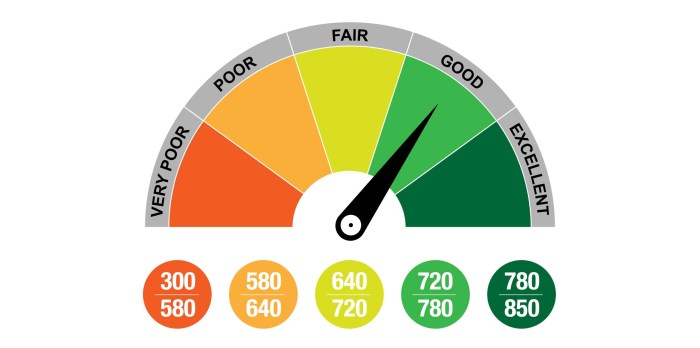

One success story involves a young couple who increased their credit score from the low 600s to the mid 700s within a year by paying off outstanding debts and monitoring their credit report regularly.

Overall, improving your credit score can not only help you achieve your financial goals but also provide you with greater financial flexibility and opportunities in the future.