Customer Acquisition Cost sets the stage for businesses to understand the cost of acquiring new customers, diving deep into strategies and factors that influence this crucial metric. From defining the concept to exploring optimization techniques, this topic is a must-read for entrepreneurs and marketers alike.

Explore the ins and outs of Customer Acquisition Cost and unlock the secrets to enhancing your business’s growth potential.

What is Customer Acquisition Cost?

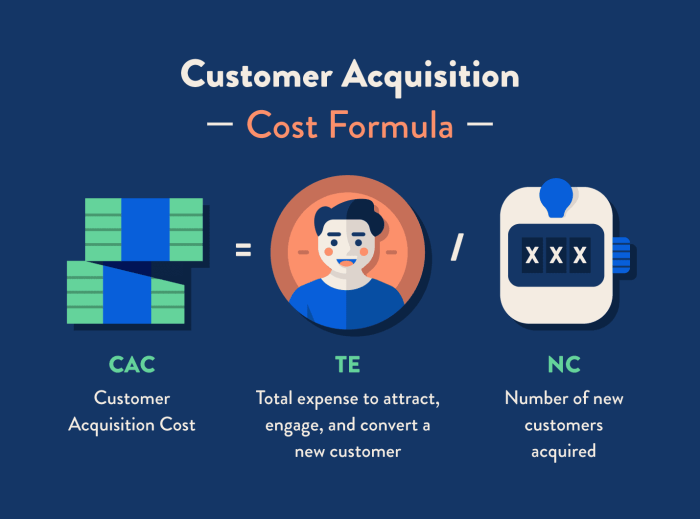

Customer Acquisition Cost (CAC) is the total cost a business incurs to acquire a new customer. This includes all marketing and sales expenses tied to attracting and converting a prospect into a paying customer.

Importance of Customer Acquisition Cost for Businesses

Understanding CAC is crucial for businesses as it helps in determining the effectiveness of their marketing and sales strategies. By calculating CAC, companies can evaluate the return on investment for acquiring customers and make informed decisions on resource allocation.

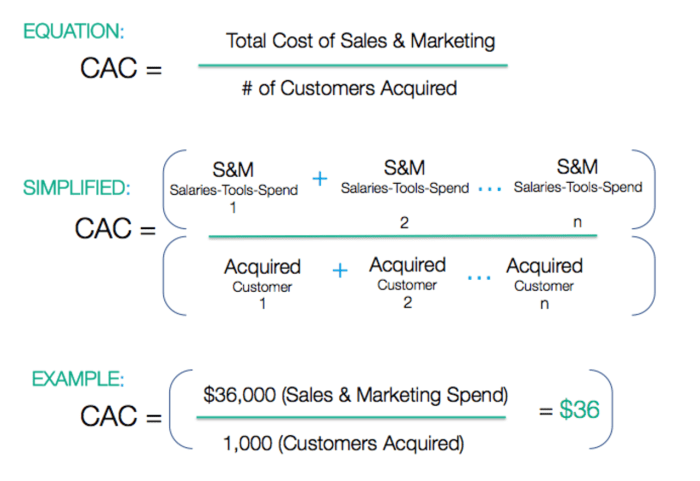

- Calculating Customer Acquisition Cost:

Total CAC = Total Sales and Marketing Costs / Number of New Customers Acquired

Examples of Customer Acquisition Cost Calculation

Different industries may calculate CAC in various ways based on their specific business models and customer acquisition channels. Here are a few examples:

- Software as a Service (SaaS) Industry:

- E-commerce Industry:

- Subscription Box Industry:

Total CAC = Total Sales and Marketing Costs / Number of New Customers Acquired

Total CAC = Total Marketing Spend / Number of Customers Acquired through Marketing Channels

Total CAC = Total Cost of Goods Sold + Marketing Costs / Number of New Subscribers

Factors influencing Customer Acquisition Cost

When it comes to Customer Acquisition Cost (CAC), there are several key factors that can significantly impact how much a company has to spend to acquire new customers. Let’s dive into some of the most important influencers of CAC.

Marketing Channels, Customer Acquisition Cost

The marketing channels a company chooses to utilize can have a major impact on its Customer Acquisition Cost. Different channels have varying costs associated with them, and some may be more effective at reaching the target audience than others. For example, digital marketing channels like social media ads and search engine optimization () can be more cost-effective than traditional channels like TV or print advertising. By analyzing the performance of each channel, companies can optimize their marketing spend and reduce CAC.

Customer Segmentation

Customer segmentation is another critical factor that can influence Customer Acquisition Cost. By dividing customers into different segments based on demographics, behavior, or other characteristics, companies can tailor their marketing efforts to specific groups. This targeted approach can lead to higher conversion rates and lower CAC. For instance, a company may find that customers in a certain geographical area are more likely to make a purchase, allowing them to focus their marketing efforts and resources on that segment.

Strategies to optimize Customer Acquisition Cost

Reducing Customer Acquisition Cost is crucial for maximizing profits and ensuring sustainable growth. By implementing the right strategies, businesses can attract new customers more efficiently and effectively.

Tips for reducing Customer Acquisition Cost

- Focus on targeted marketing campaigns to reach potential customers who are more likely to convert.

- Utilize social media and digital advertising to reach a wider audience at a lower cost compared to traditional marketing channels.

- Optimize your website for conversions by improving user experience and streamlining the purchasing process.

- Implement referral programs to incentivize existing customers to bring in new leads.

The role of customer retention in improving Customer Acquisition Cost

Customer retention plays a significant role in reducing Customer Acquisition Cost. By focusing on keeping existing customers satisfied and engaged, businesses can benefit from repeat purchases and referrals, which are more cost-effective than acquiring new customers.

Leveraging data analytics to optimize Customer Acquisition Cost

Data analytics can provide valuable insights into customer behavior, preferences, and trends. By analyzing this data, businesses can identify the most effective marketing channels, target the right audience, and optimize their marketing campaigns for better results and lower Customer Acquisition Cost.

Calculating Customer Acquisition Cost

To calculate Customer Acquisition Cost (CAC), you need to follow a step-by-step process that involves gathering specific data and performing simple mathematical calculations. This metric is crucial for businesses as it helps in understanding the effectiveness of their marketing and sales efforts.

Step-by-Step Guide

- First, determine the time frame you want to analyze. It could be monthly, quarterly, or annually.

- Calculate the total amount spent on marketing and sales activities within that time frame. This includes costs related to advertising, salaries, and any other expenses directly attributed to acquiring customers.

- Next, count the number of customers acquired during the same period.

- Divide the total marketing and sales costs by the number of customers acquired to get the Customer Acquisition Cost.

Importance of Tracking and Analyzing

Tracking and analyzing trends in Customer Acquisition Cost is essential for businesses to make informed decisions and optimize their strategies. By monitoring changes in CAC over time, companies can identify areas where they are overspending or underperforming. This data allows them to adjust their marketing tactics, target audience, or pricing strategies accordingly to improve profitability.

Tools for Calculating CAC

- Customer Relationship Management (CRM) software like Salesforce or HubSpot can help track and analyze customer acquisition data.

- Marketing automation platforms such as Marketo or Pardot offer features to calculate and monitor CAC metrics.

- Specialized analytics tools like Google Analytics or Kissmetrics provide insights into customer behavior and acquisition costs.